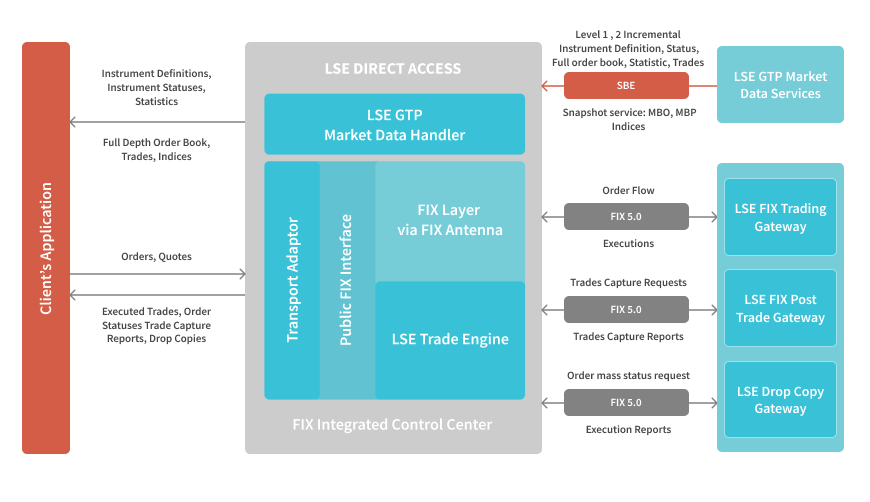

EPAM provides pre-certified connectivity solutions for direct access to GTP Market Data, FIXTrading Gateway, Post Trade and Drop Copy Services of the London Stock Exchange.

LSE GTP Market

B2BITS LSE GTP Handler is an ultra-low latency connectivity solution providing access to The Group Ticket plan market feeds such as Level1/Level2 Market Data Feeds and Indices services of London Stock Exchange. It has the following features:

- Connects and maintains connection to The Group Ticket plan market feeds via UDP

- Provides the user with current market data (Instrument Definitions, Instrument Statuses, Statistics, Full Depth Order Book, Indices)

- Automatically arbitrates between Feed A and Feed a

- Fills gap using TCP Replay and Full Snapshot TCP Recovery methods

- Provides flexible C++ API to open the connection, receive details of all instruments, quotes, orders and trades via call-back

- Well-packaged with pre-compiled binaries for chosen platform, API Guide, set of "Quick Start" samples, set of utilities with sources (traffic dump, traffic replay), pre-compiled binaries for the chosen platform, programmer's Guide with code examples, detailed API reference and a sample application with source code

LSE FIX Trade Engine

B2BITS LSE Trade Engine is a FIX Antenna™ based low-latency solution specifically designed and preconfigured for submitting orders and/or quotes to the London Stock Exchange's New Trading System and receiving back real-time information on order statuses and executed trades. It has the following features:

- Connects and maintains connection to FIX Trading interface of London Stock Exchange via TCP/IP

- Supports all the features of the London Stock Exchange's New Trading System for order routing and market making, including mass quoting, full order management functionality and optional order book self-execution prevention

- Supports all order types available at LSE including Iceberg, Hidden and Pegged orders

- Supplied as library (.dll/.so) with user-friendly intuitive ANSI C++/.NET/Java public interface or as standalone application

- Latency is under one microsecond between order creating and sending it to the socket and from the socket to call-back while getting a message

- Equipped with rich UI simplifying configuration and maintenance as well as allowing monitoring session statuses and parameters in real-time on desktop app or web browser.

LSE Post Trade Engine

LSE Post Trade engine based on FIX Antenna™ library or FIXEdge™ application server provides access to LSE Post Trade Gateway to receive real-time information on executed trades and has the following features:

- Connects and maintains connection to LSE Post Trade Gateway via TCP/IP

- Fully supports LSE Post Trade Gateway workflow, provides ability for receiving full details of executed trades as well as notifications of any trade cancel or correction

- Provides the ability to request details of eligible trades matching specified criteria, e.g. for a selected set of instruments or for a specified party, trade type or order

- Supports LSE FIX 5.0SP2 dictionary

- Supplied as library (.dll/.so) with user-friendly intuitive ANSI C++/.NET/Java public interface or as standalone application

- High performance/Low latency: in C++ implementation, delivers over 60,000 messages per second on a single CPU and adds up to 16 microseconds' latency on 100 Mbps network with persistence and 6microseconds' latency on 100 Mbps network without persistence

- Equipped with rich UI simplifying configuration and maintenance as well as allowing monitoring session statuses and parameters in real-time on desktop app or web browser.

LSE Drop Copy Engine

LSE Drop Copy engine based on FIX Antenna™ library or FIXEdge™ application server provides access to LSE Drop Copy Gateway to receive additional copies of the Execution Reports or download current status of active orders in the event of a failure. It has the following features:

- Connects and maintains connection to LSE Drop Copy Gateway via TCP/IP

- Fully supports LSE Drop Copy Gateway workflow including 'Copy To' functionality to receive copies of each eligible Execution Report in a real time or for selected firms/Trader Groups

- Provides the ability to recover the status of all active orders in the event of a system failure via OOBD service

- Supports LSE FIX 5.0SP2 dictionary

- Supplied as library (.dll/.so) with user-friendly intuitive ANSI C++/.NET/Java public interface or as standalone application

- High performance/Low latency: in C++ implementation, delivers over 60,000 messages per second on a single CPU and adds up to 16 microseconds' latency on 100 Mbps network with persistence and 6microseconds' latency on 100 Mbps network without persistence

- Equipped with rich UI simplifying configuration and maintenance as well as allowing monitoring session statuses and parameters in real-time on desktop app or web browser.

The deployment of this solution will provide the following benefits:

- Pre-certified with London Stock Exchange

- Quick start and benchmark samples assuring prompt familiarizing with the software

- Re-use of a proven and certified technology with direct market access

- Reduced time to market and cost of implementation and operation

- Lower technical risk for support and maintenance

- 24x7 support provided worldwide

- Availability of having solution customized to end-user specifics and requirements

- Availability of "on-demand" software escrow